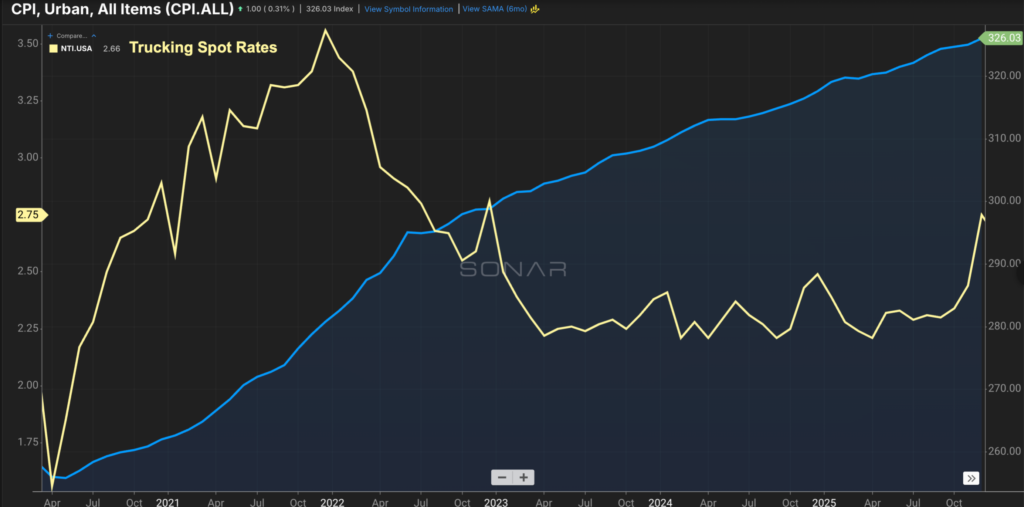

The U.S. trucking industry continues to contend with a sobering economic reality: spot rates have not kept pace with inflation. The result has been sustained margin compression for carriers and mounting financial strain for truckers across the country.

The disconnect is clearly illustrated by comparing national spot trucking rates (SONAR National Truckload Index) with the Consumer Price Index (CPI). While inflation has steadily climbed since 2020, trucking rates have lagged far behind.

As of mid-January 2026, national spot rates are showing renewed strength following a late-2025 rally. According to SONAR, the National Truckload Index currently sits near $2.75 per mile (inclusive of fuel), approaching multi-year highs.

However, this improvement masks a deeper structural issue. If spot rates had merely tracked cumulative CPI growth since March 2020—prior to the pandemic-era freight surge—today’s rates would be materially higher, closer to $3.50 per mile or more. That represents a shortfall of roughly 27%.

This gap is far from theoretical. It translates directly into real financial pain for owner-operators and small to mid-sized carriers, who face sharply higher operating costs with insufficient revenue growth. Fuel, maintenance, insurance, tires, driver wages, equipment, and regulatory compliance expenses have all risen substantially since 2020. Many carriers are operating at breakeven—or below—forcing some out of business entirely. This attrition has contributed to the gradual capacity tightening observed in late 2025 and early 2026.

The post-pandemic rate cycle underscores the imbalance:

- Spot rates surged in 2021–2022 amid supply chain disruptions and extraordinary demand.

- Rates then collapsed throughout 2023 and much of 2024, falling well below inflation-adjusted, pre-pandemic levels.

- In recent months, spot rates have rebounded, climbing through the 2025 holiday season and into early 2026, supported by seasonal demand, winter weather disruptions, and tightening capacity.

- Despite this rally, long-term inflation-adjusted pricing remains meaningfully depressed.

Compounding the issue was a prolonged capacity glut fueled by an influx of new market entrants in prior years—many of whom did not meet the operational and compliance standards historically expected of U.S. trucking professionals. The result was years of suppressed pricing that shifted inflationary pressure almost entirely onto carriers.

Truckers are the backbone of the American supply chain, yet many continue to struggle under rates that fail to reflect the true cost of moving freight. Sustainable pricing is not a luxury—it is a necessity for industry stability.

Looking ahead to 2026, several forces may help close the gap between rates and inflation:

- Increased FMCSA enforcement, including scrutiny of training providers, non-compliant CDLs, language proficiency requirements, and illegal operating practices.

- Years of unprofitable conditions that have severely weakened carrier balance sheets.

- Continued capacity discipline following widespread attrition.

- A potential recovery in industrial, construction, and housing demand.

- Persistent regulatory pressure and rising equipment and ownership costs.

The data is increasingly clear. Shippers have benefited from an extended period of suppressed trucking rates, but that environment is likely nearing its end. As compliance enforcement accelerates and capacity continues to tighten, pricing power is gradually shifting back toward carriers.

With spot rates showing renewed momentum and structural forces reshaping supply, 2026 presents an opportunity for trucking companies to begin recovering years of lost profitability. Shippers should plan accordingly—and prepare for a materially different rate environment in the year ahead.