Less-than-truckload carrier Saia says it is seeing more tailwinds than headwinds heading into the new year, even as the cost of a multi-year network expansion continues to pressure near-term results.

The Johns Creek, Georgia-based carrier has opened 39 terminals over the past three years, transforming the company into a true national LTL provider. While the expanded footprint is improving Saia’s ability to compete for freight from national shippers, startup costs tied to the new facilities again weighed on quarterly performance.

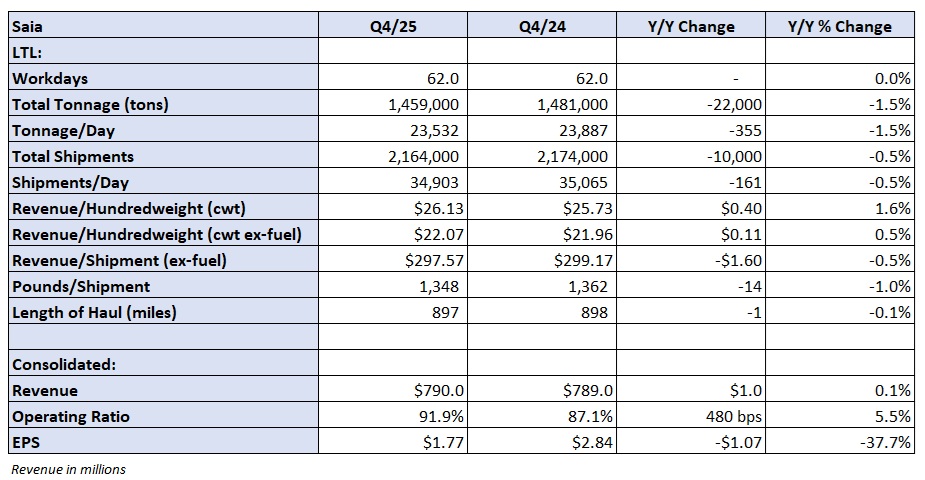

Saia reported fourth-quarter earnings per share of $1.77 on Tuesday before the market opened, down 38% year over year and 14 cents below consensus estimates. Results included $4.7 million in adverse claims developments during the quarter. Excluding those costs, adjusted EPS would have been $1.91, in line with expectations.

The broader network is allowing Saia to pursue higher-quality, nationwide freight and build shipment density over time. However, carrying the incremental operating costs has pushed margins to multiyear lows in recent quarters—a trend management expects to begin reversing this year.

Saia’s (NASDAQ: SAIA) fourth-quarter operating ratio came in at 91.9%, translating to an 8.1% operating margin. That result was 480 basis points worse year over year and 430 basis points worse sequentially. Management had guided to 300 to 400 basis points of sequential deterioration, with higher insurance costs accounting for roughly 60 basis points of pressure.

Management said the fourth quarter could mark the low point for margins, despite winter storms weighing on results early in the first quarter, which is typically the seasonally weakest period.

On the earnings call, executives noted the company usually sees 30 to 50 basis points of sequential operating ratio deterioration from the fourth to the first quarter. This year, Saia expects to outperform that trend and potentially post sequential improvement, given the depressed starting point. The outlook could translate to year-over-year improvement versus the 91.1% operating ratio recorded in the first quarter of 2025. (Guidance was based on an adjusted fourth-quarter OR of 91.3%, excluding the insurance impact.)

Looking further out, Saia is forecasting full-year margin improvement of 100 to 200 basis points in 2026, with the upper end of the range dependent on modest gains in volume and yield. Management said it still expects margin improvement even if macroeconomic conditions remain soft.

“A $2 billion capital investment, like what we’ve deployed in this business, the returns that we are expecting are sub-80 OR,” said Saia President and CEO Fritz Holzgrefe on the call.

If you want, I can tighten it even more, add KPI bullets, or reshape it to match a specific outlet’s house style.